In recent years, Chinese electric tricycle market has experienced a period of rapid growth. From 2017 to 2024, the market size increased from 25.7 billion yuan to 45 billion yuan. By the end of 2024, the number of electric tricycles in ownership in China had reached approximately 70 million, with annual sales remaining at around 15 million units.

Against this backdrop, the vast international market has become a new option for enterprises to break through. Data shows that the global electric tricycle market sales reached 61.86 billion yuan in 2023 and are expected to soar to 149.89 billion yuan by 2030.

Domestic electric tricycles have achieved remarkable results in their overseas expansion journey. In 2023, their export volume reached approximately 600,000 units, a year-on-year increase of 20%, and the export value neared 5 billion US dollars, with a growth rate of 25%. In 2024, the export volume rose to 650,000 units and the export value hit 5.5 billion US dollars, continuing the growth trend. Industry clusters such as Wuxi have performed particularly prominently. In 2024, the number of local electric vehicle and motorcycle export enterprises in Wuxi reached 299, with an export value of nearly 3.3 billion yuan, a year-on-year increase of 46.6%. Since the start of 2025, many domestic electric tricycle enterprises have remained fully booked with overseas orders.

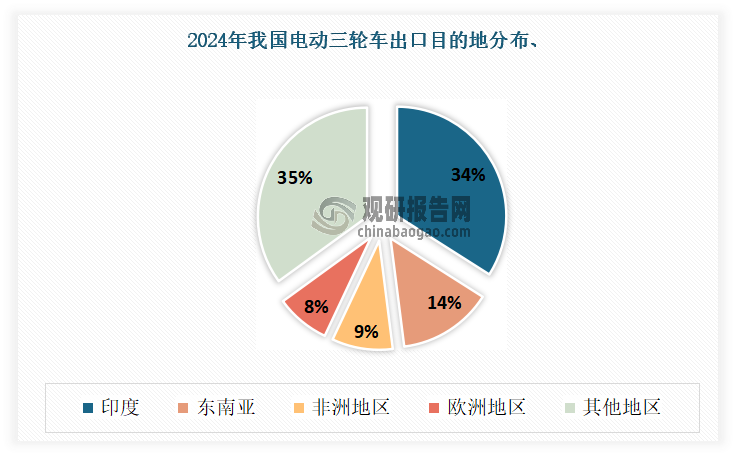

In terms of market distribution, India is the largest overseas market. In 2024, the export volume to India reached approximately 220,000 units, accounting for 34% of the total export volume, and there was often a situation where demand outstripped supply (or "it was often hard to get one due to high demand"). Driven by its profound tricycle culture, Southeast Asia absorbed 14% of the total export volume. With the improvement of infrastructure, the African market accounted for 9% of the total exports. Meanwhile, Europe contributed 8% of the share under the impetus of green travel policies.

High cost-effectiveness is the key advantage that makes "Made in China" products successful. Compared with traditional pickup trucks that cost tens of thousands of US dollars, domestic electric tricycles, even after adding shipping fees and tariffs, are only priced at 3,000-4,000 US dollars. In addition, the highly customized services—adjustments can be made on demand from aspects such as color, enclosure level, power, and vehicle size—accurately meet the diverse needs of overseas consumers.

The ability of China's electric tricycles to make a name for themselves in overseas markets is inseparable from the support of mature industrial clusters. Currently, there are 1.517 million enterprises related to electric vehicles across the country, and the industry is mainly concentrated in places such as Feng County (Xuzhou, Jiangsu Province), Xishan District (Wuxi), Luoyang (Henan Province), and Linyi (Shandong Province).

This cluster effect has achieved full-link coverage from R&D and production to sales, with a prominent scale effect. It provides a solid guarantee for the improvement of product quality and cost control, and also enables China's electric tricycles to gain an advantageous position in global competition.

From the alleys of urban and rural areas to the global market, the counterattack journey of China's electric tricycles is not only a victory of cost-effectiveness advantages, a reflection of the strength of industrial clusters, but also a result of continuous innovation by enterprises. In the future, with the in-depth application of intelligent technologies and the continuous expansion of overseas markets, this "national means of transportation" is expected to write more brilliant chapters on the global stage.